Senior U.S. and Chinese officials will meet in Stockholm from July 27 to 30, 2025, to resume high-stakes negotiations aimed at extending the existing tariff truce before the looming August 12 deadline. The talks mark the third in-person round since the temporary agreement was brokered in May, following earlier sessions in Geneva and London. Leading the delegations are U.S. Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng.

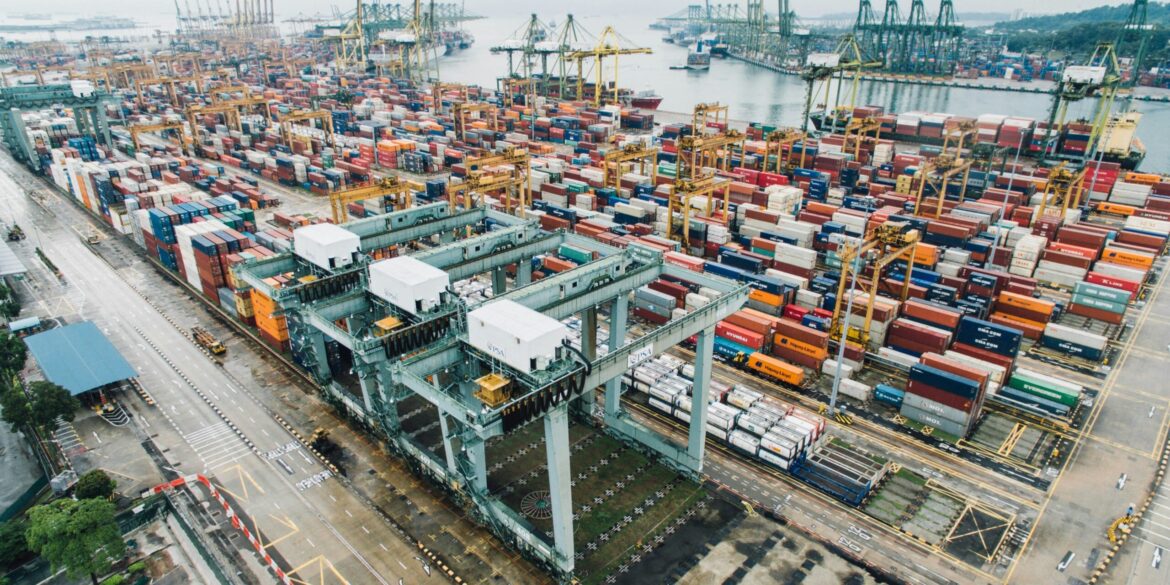

The current truce, which scaled down punitive tariffs that previously reached as high as 145% on U.S. goods and 125% on Chinese imports, has been critical in easing tensions. A reversion to those levels would pose a significant threat to global supply chains and international trade flows. The temporary rates, currently around 30%, have offered industries a brief reprieve. Negotiators hope to solidify this relief with a time-limited extension of the truce, expected to be around 90 days.

U.S. officials have signaled their intent to press China on deeper structural issues. These include reining in industrial overcapacity and moving toward a more consumption-led economy, reducing reliance on export subsidies and state support that have drawn criticism for distorting global markets. Additionally, Washington is expected to raise concerns over China’s purchases of oil from Russia and Iran, signaling a broader integration of foreign policy issues into the trade dialogue.

These discussions also reflect a cautious effort by both sides to de-escalate tensions and avoid a new round of economic disruptions. Earlier talks led to China lifting its ban on rare earth exports to the U.S. and, in return, saw Washington ease restrictions on semiconductor design software and aircraft components. While limited in scope, these measures were seen as confidence-building steps.

Read Also: https://republicandigest.com/markets-eye-impact-of-august-tariff-deadline-and-fed-policy-stance/

Beyond the bilateral talks, the U.S. has recently reached separate tariff agreements with several other countries, including Japan, the Philippines, and Indonesia. These deals have helped contain broader regional uncertainty and demonstrate Washington’s flexible approach to tariff diplomacy.

Despite hopes for progress, analysts caution that major breakthroughs in Stockholm are unlikely. However, even a modest agreement to extend the current truce could bring welcome relief to global markets already rattled by ongoing supply disruptions and geopolitical instability. Equity markets and commodity sectors have reacted positively to signs of continued dialogue, with oil prices edging higher amid optimism that a trade blowup can be avoided.

At the same time, both sides are looking toward the possibility of a presidential summit between Donald Trump and Xi Jinping later this year, potentially at the APEC summit in South Korea. Any groundwork laid in Stockholm could pave the way for such a meeting, which would provide a high-level platform for broader strategic and economic negotiations.

While the upcoming negotiations may not resolve the more entrenched issues in U.S.-China economic relations, they represent a meaningful effort to maintain diplomatic momentum and avoid a sharp deterioration. Securing even a short-term extension would be viewed as a win for both sides and a signal of intent to stabilize one of the world’s most critical bilateral relationships.

For more, see the original reporting by Reuters: U.S. and China to resume tariff talks in effort to extend truce