On April 3, 2025, a group of Republican senators introduced new legislation aimed at blocking President Joe Biden’s proposed tax hike on small businesses and corporations. The bill, named the “Small Business Protection Act,” seeks to prevent the Biden administration from raising the corporate tax rate from 21% to 28%, which is part of the president’s broader effort to fund new infrastructure and social programs. Republicans argue that such a tax increase will stifle economic growth, burden small businesses, and lead to job losses.

Senator John Barrasso (R-WY), the lead sponsor of the bill, was joined by Senators Ted Cruz (R-TX), Shelley Moore Capito (R-WV), and Mike Lee (R-UT). Barrasso emphasized that raising taxes on corporations and small businesses will make it more difficult for U.S. companies to compete globally, leading to higher prices for consumers and fewer job opportunities for Americans.

“Raising taxes on job creators will have a devastating effect on working-class Americans,” Barrasso said during the bill’s unveiling. “This bill will ensure that we protect small businesses from punitive taxes and that American families don’t have to bear the burden of higher costs.”

The Biden administration has proposed the corporate tax hike as part of a plan to fund a $2 trillion infrastructure package, which aims to modernize the country’s roads, bridges, and public transit systems, as well as fund green energy initiatives and social programs. The proposed corporate tax rate increase would apply to businesses with taxable income over $400,000, and the revenue would be used to pay for the president’s spending plans.

Republicans, however, argue that the tax hike would lead to fewer jobs, particularly in industries that rely on significant capital investment, such as manufacturing and energy. They contend that businesses would be forced to pass the higher tax burden onto consumers in the form of increased prices for goods and services.

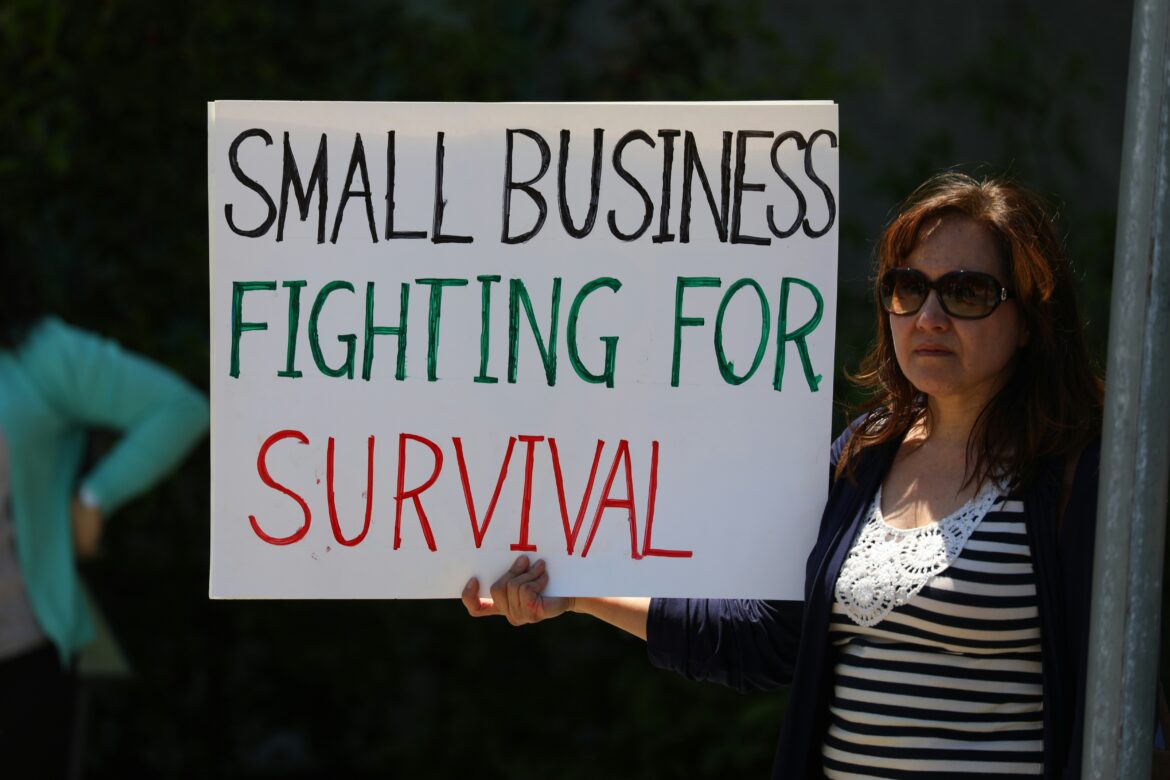

Industry groups like the U.S. Chamber of Commerce and the National Federation of Independent Business (NFIB) have expressed support for the GOP bill, emphasizing that the tax hikes would hurt small businesses that are already struggling with inflation and supply chain disruptions.

“We’re already seeing the impact of inflation and higher costs on businesses,” said Karen Harned, executive director of NFIB. “Raising corporate taxes would only add to the burden that small businesses are already facing.”

The Biden administration and some Democrats argue that the tax increase is necessary to ensure that corporations pay their fair share of taxes and to fund investments in infrastructure and clean energy. The administration insists that the corporate tax hike will help reduce income inequality and create more equitable growth in the economy.

“This bill is part of our efforts to invest in America’s future,” said Treasury Secretary Janet Yellen. “The wealthiest corporations must contribute their fair share to build a more sustainable economy for all Americans.”

The GOP bill to block the tax hike will likely be a central issue in the upcoming election cycle, with both sides of the debate arguing over the economic impact and the future of U.S. tax policy. The outcome of this legislative push will have significant implications for the future of business taxation and the economy as a whole.